New Child Tax Credit Law For 2024 – Under current law, the credit is only partially a longtime proponent of expanding the child tax credit. Ohio Senator Sherrod Brown, another member of the Finance Committee and advocate of . This narrative news piece examines the enhanced Child Tax Credit and its effects on families. According to the new law, the 2023 Child Tax Credit has increased from $2,000 in 2022 to $3,000 for .

New Child Tax Credit Law For 2024

Source : itep.org

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

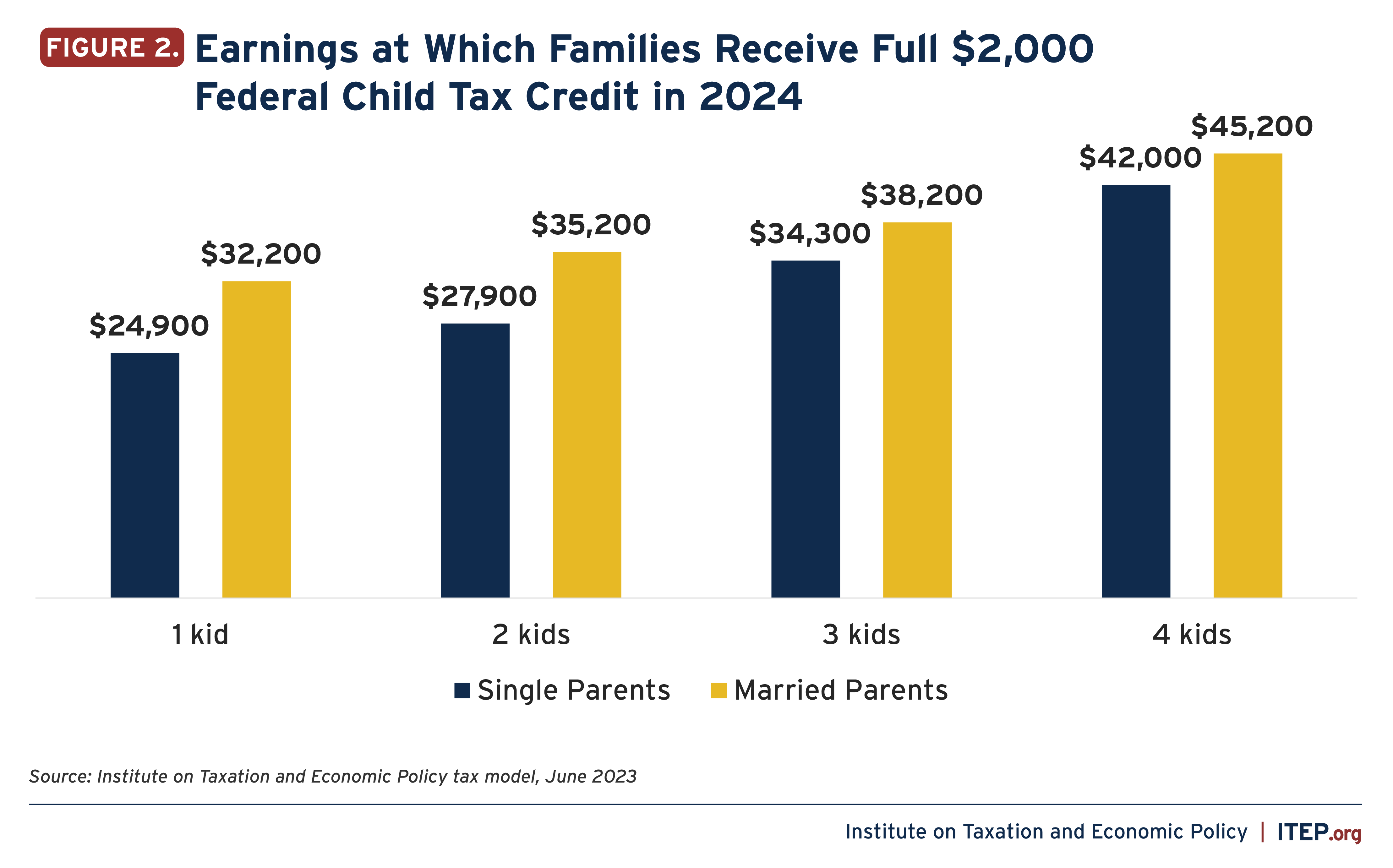

Expanding the Child Tax Credit Would Help Nearly 60 Million Kids

Source : itep.org

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

Child Tax Credit 2023 2024: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

Child tax credit expansion, business incentives combined in new

Source : floridaphoenix.com

Child Tax Credit 2024: Easy guide to your credit for dependents:

Source : www.usatoday.com

Lawmakers Strike Deal on Expanded Child Tax Credit, but Face Long

Source : www.nytimes.com

New Child Tax Credit Law For 2024 Expanding the Child Tax Credit Would Advance Racial Equity in the : For the first time, New Mexico families will be able to claim a state child tax credit on their state income tax returns this year for each of their children, a simple act that for many will have a . An analysis by the left-leaning Center on Budget and Policy Priorities found that around 16 million low-income children another element of the 2021 expansion—which would allow households without .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)